In recent decades, there have been significant advances in the development of new therapeutic approaches. Proteolysis-Targeting Chimera (PROTAC)* offers a new approach to some disease treatments, attracting more and more drug developers' attention in the last 5 years. Moreover, PROTAC as a new therapeutic technology has facilitated substantial investment worldwide. In this paper, the PROTAC's structure and mechanism of action, its global landscape, the DMPK challenge in PROTAC research, and the solutions are summarized.

Structure and Mechanism of Action of PROTAC

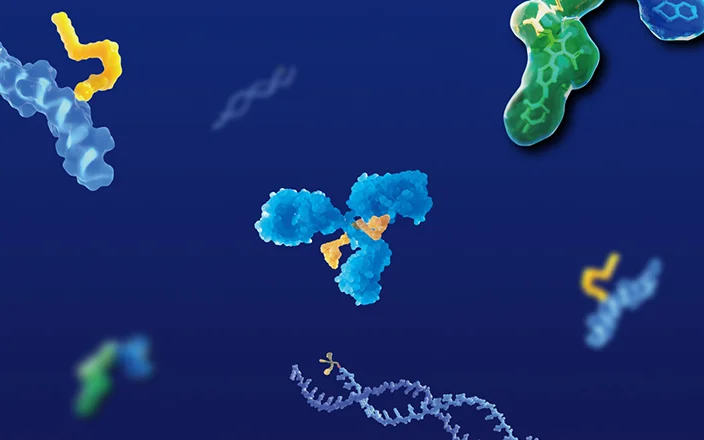

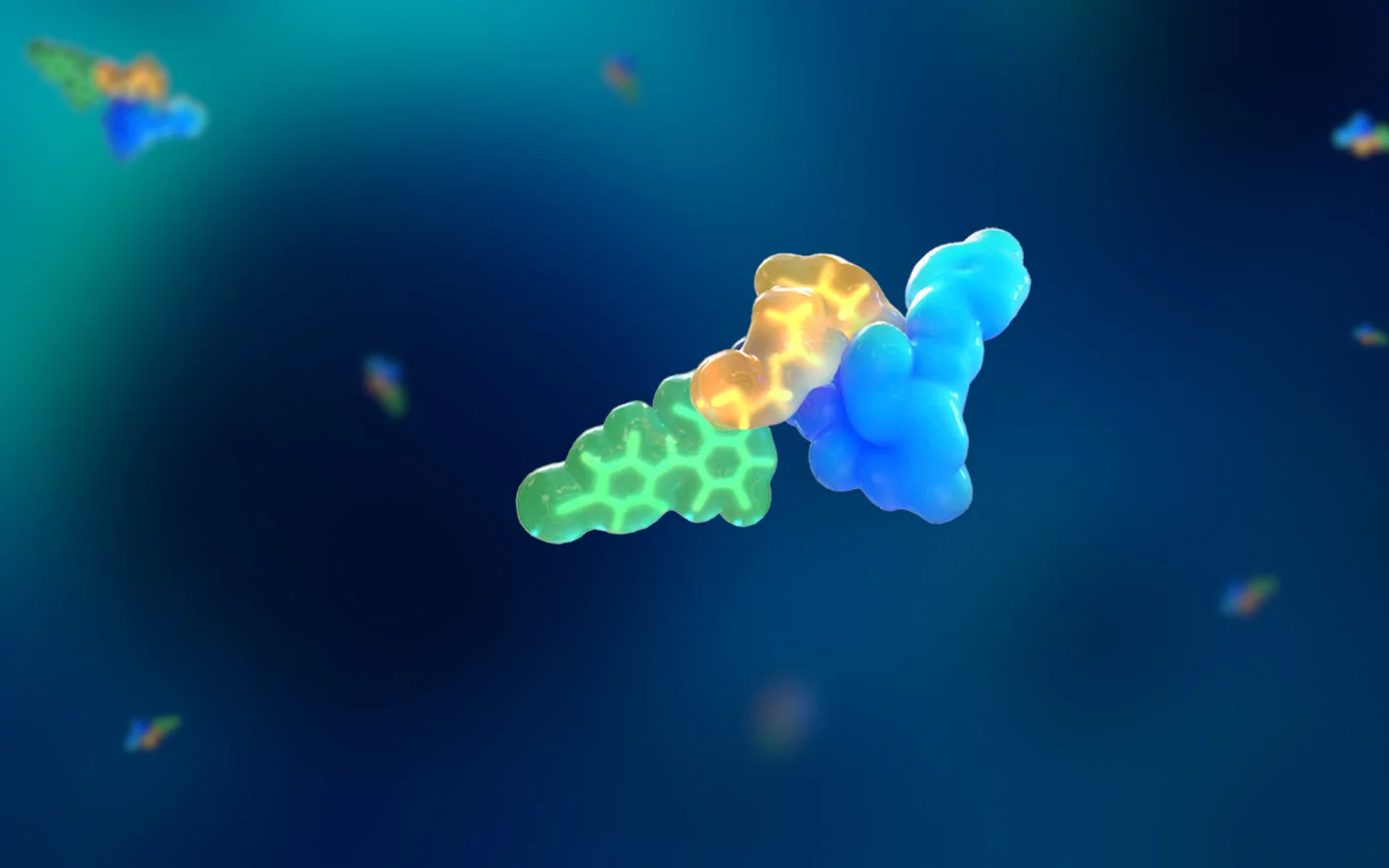

PROTAC utilizes the body’s natural protein degradation mechanism, namely the ubiquitin-proteasome system.1 As a bifunctional molecule, PROTAC consists of three key structural parts: a ligand used to bind the target protein; a ligand binding the ubiquitin-protein ligase (E3); and a linker connecting the two ligands (Figure 1).

Figure 1: Example of PROTAC structure

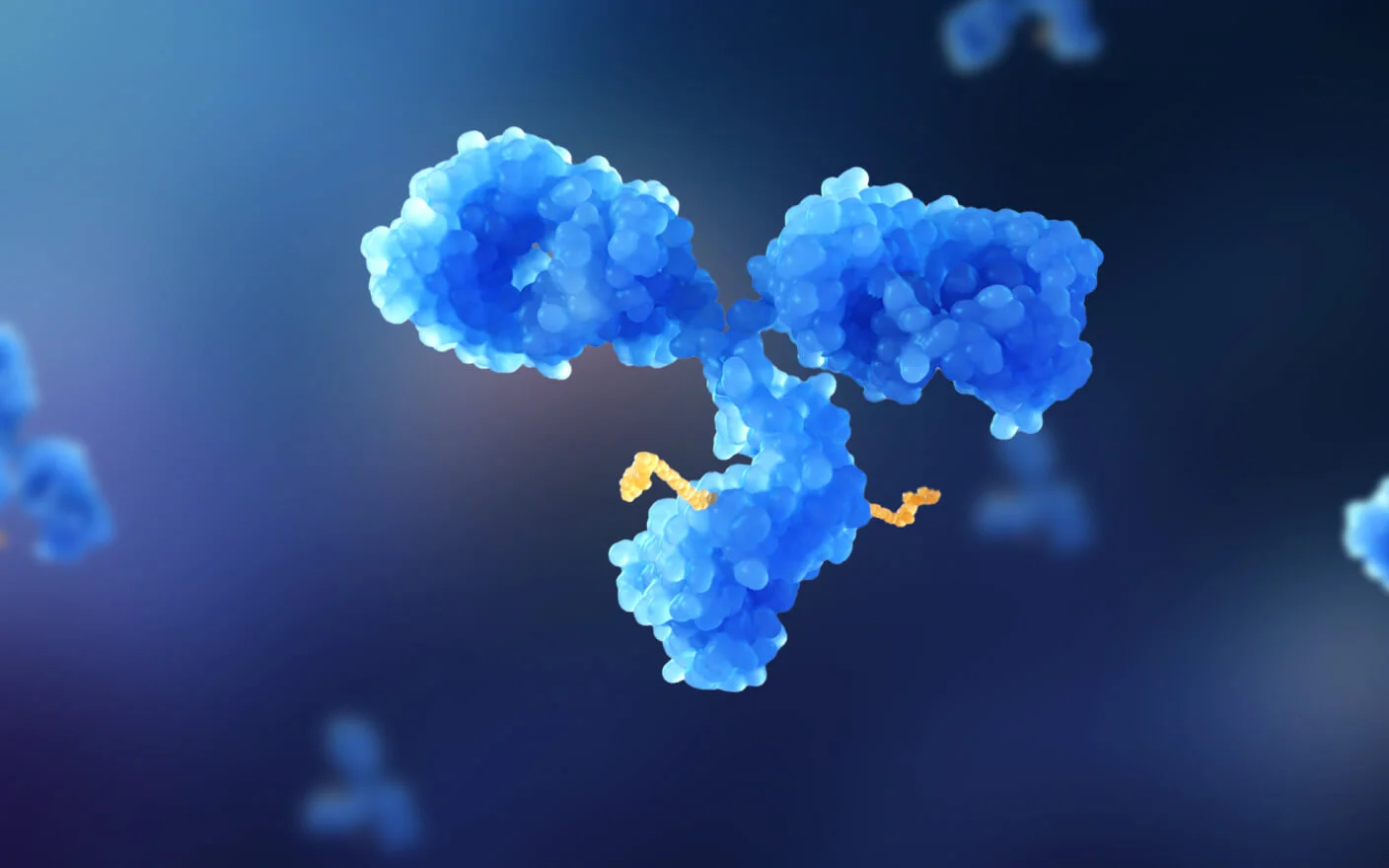

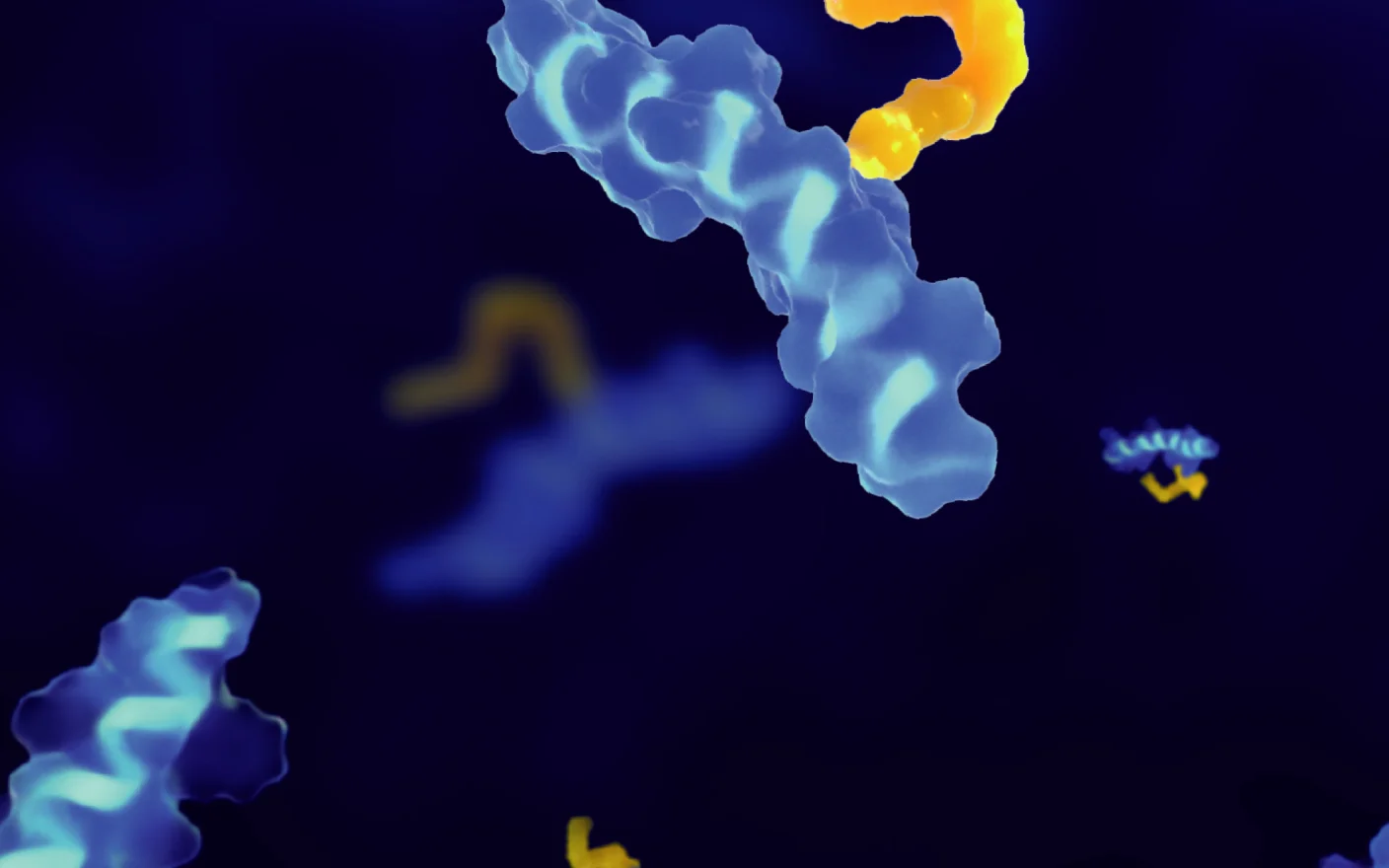

Due to its unique structure, PROTAC induces E3 ligase to label the target protein with ubiquitin by bringing the E3 ligase and the target protein into proximity, promoting the degradation of the target protein, and the PROTAC molecules that fall off after the target protein degradation can continue to be recycled (Figure 2). Different from the occupancy drive pharmacology of most small molecule drugs, PROTAC can access previously inaccessible proteins without occupying an active pocket and relying on target occupancy to disrupt target protein, this is known as event-driven pharmacology.

Therefore, PROTAC has many advantages in drug discovery:

It provides the potential for the development of many undruggable protein targets without active sites.

It has the potential to overcome some of the disadvantages of small molecules such as drug resistance, while retaining the advantage of acting directly on intracellular targets.

It has a higher oral bioavailability compared to antibodies or oligonucleotides, also reducing production challenges.

Figure 2: Mechanism of action of PROTAC.2

Summary of PROTAC Drugs in Development

PROTAC offers an attractive therapeutic concept to control target protein levels through event-driven pharmacology. Although this is a relatively new modality, it has made rapid progress in the drug discovery pipeline.

(1)PROTAC research and development progress: International pharmaceutical companies

PROTAC has boomed in the last two years with Arvinas' two candidate molecules, ARV-110 and ARV-471, being the first to achieve positive clinical data. In addition, the company’s third PROTAC molecule (ARV-766) is about to enter the clinical phase. Other international companies that focus on developing protein degraders, such as Kymera Therapeutics, C4 Therapeutics and Nurix Therapeutics, have a molecule in the clinical phase I. In addition, other pharmaceutical companies such as Bristol-Myers Squibb, Dialectic Therapeutics, Foghorn Therapeutics, and Accutar Biotechnology also own a PROTAC molecule in clinical phase I.

Company | PROTAC | Indications | Target | Study Phase |

Arvinas, Inc. https://www.arvinas.com/ | ARV-110 | Metastatic castration-resistant prostate cancer (mCRPC) | Androgen receptor (AR) | Clinical phase II |

ARV-471 | Breast cancer (ER+/HER2-Breast Cancer) | Estrogen receptor (ER) | Clinical phase II | |

ARV-766 | Metastatic castration-resistant prostate cancer (mCRPC) | AR | Clinical phase I | |

AR-V7 | Metastatic castration-resistant prostate cancer (mCRPC) | AR-FL & AR-V7 | Preclinical | |

Nurix Therapeutics, Inc. https://www.nurixtx.com/ | NX-2127 | B cell malignancies | BTK + IMiD Activity | Clinical phase I |

NX-5948 | B cell malignancies and autoimmune diseases | BTK | Clinical phase I | |

Kymera Therapeutics, Inc. https://www.kymeratx.com/ | KT-474 | Allergic dermatitis, hidradenitis suppurativa, rheumatoid arthritis | Interleukin-1 receptor-associated kinase 4 (IRAK4) | Clinical phase I |

KT-333 | Tumor | STAT3 | Clinical phase I | |

KT-413 | B-cell lymphoma with MYD88 gene mutation | IRAK4 | Clinical phase I | |

C4 Therapeutics, Inc. https://c4therapeutics.com/ | CFT7455 | Relapsed/refractory non-Hodgkin's lymphoma or multiple myeloma | IKZF1/3 | Clinical phase I/II |

CFT8919 | Non-small cell lung cancer (NSCLC) with drug-resistant EGFR mutation | EGFR L858R | IND application | |

CFT8634 | Synovial sarcoma and smarcb1-deficient solid tumors | BRD9 | Clinical phase I/II | |

Bristol-Myers Squibb https://www.bms.com/ | AR-LDD | Prostate cancer | AR | Clinical phase I |

Dialectic Therapeutics, Inc. https://www.dtsciences.com/ | DT-2216 | Tumor | BCL-XL | Clinical phase I |

Foghorn Therapeutics, Inc. https://foghorntx.com/ | FHD-609 | Synovial sarcoma | BRD9 | Clinical phase I |

Accutar Biotechnology Inc. https://www.accutarbio.com/ | AC0682 | Breast cancer | ER | Clinical phase I |

AC0176 | Prostate cancer | AR | Clinical phase I | |

AC0676 | Autoimmunity | BTK WT & C481S | IND application |

Table 1. PROTAC research and development progress of some international pharmaceutical

Note: The information was obtained from the official websites of the above companies and the deadline for information collection is December 16, 2022.

(Only research pipelines with compounds are listed.) Vividion Therapeutics, ERASCA and other PROTAC companies do not disclose pipeline information.

(2)PROTAC research and development progress: Chinese pharmaceutical companies

In China, many companies are also developing PROTAC molecules, such as Lynk Pharmaceuticals, Kintor Pharmaceuticals, Haisco, Meizer Pharma, Cullgen, Hinova Pharmaceuticals, BeiGene and Seed Therapeutics, a subsidiary of BeyondSpring, have all laid out in the PROTAC field. Among them, Lynk Pharmaceuticals, Kintor Pharmaceuticals, BeiGene and Haisco all own a PROTAC molecule in clinical phase I.

Company | PROTAC | Indications | Target | Study Phase |

Lynk Pharmaceuticals Co., Ltd. | LNK01002 | Hematological tumor | — | Clinical phase I |

Kintor Pharmaceutical Limited | GT20029 | Androgenetic alopecia, acne | AR | Clinical phase I |

Haisco Pharmaceutical Group Co., Ltd. | HSK29116 | B-cell malignancies | BTK | Clinical phase I |

Shanghai Meizer Pharmaceuticals Co., Ltd. | MZ-001 | B cell malignancies and autoimmune diseases | BTK | IND application |

BeiGene Ltd. | BGB-16673 | B-cell malignancies | BTK | Clinical phase I |

Shanghai Cullgen Biotechnology Co., Ltd. | CG416 | — | Neurotrophic factor receptor tyrosine kinase (TRK) | Preclinical |

CG428 | — | TRK | Preclinical | |

CG001419 | — | TRK | Clinical phase I/II | |

Hinova Pharmaceuticals, Inc. | HP518 | mCRPC for standard treatment failure | AR | Clinical phase I |

HC-X029 | Last-line treatment for mCRPC that has failed standard treatment | AR-sv | Preclinical | |

HC-X035 | KRAS mutated cancers | Protein tyrosine phosphatase (SHP2) containing two SH2 (Src homology-2) domains | Preclinical |

Table 2: PROTAC R&D progress of some Chinese pharmaceutical companies

Note: The information was obtained from the official websites of the above companies and the deadline for information collection is December 16, 2022.

Hangzhou Polymed Biopharma, Fendi Technology, Five Elements Bio-Technology, Seed Therapeutics and other PROTAC companies have not disclosed pipeline information.

(3)Collaborations between PROTAC companies and pharmaceutical giants

As targeted protein degradation therapies are receiving more and more attention, many companies focusing on PROTAC development, such as Arvinas, Kymera Therapeutics, C4 Therapeutics, Nurix Therapeutics, Vividion, and Seed Therapeutics, a subsidiary of BeyondSpring have gained chances to collaborate with the pharmaceutical giant.

PROTAC companies | Date | Cooperative pharmaceutical companies | Contents of Cooperation | Investments |

Arvinas, Inc. | July 2021 | Pfizer | Arvinas and Pfizer Announce Global Collaboration to Develop and Commercialize PROTAC® Protein Degrader ARV-471 | $650 million upfront payment, |

June 2019 | Bayer | Bayer and Arvinas launch a targeted protein degradation joint venture Oerth Bio to develop innovative agricultural products to increase crop yields | $110 million investment | |

January 2018 | Pfizer | Arvinas announces research collaboration and licensing agreement with Pfizer for the discovery and development of protein degradation candidate drug | $830 million upfront payment, | |

November 2017 | Roche (Genentech) | Arvinas expands strategic license agreement with Genentech | Increased to over $650 million in development and commercialization milestone payment | |

October 2015 | Roche (Genentech) | Arvinas signs strategic license agreement with Genentech | Over $300 million in development and commercialization milestone payment | |

April 2015 | Merck | Arvinas and Merck's strategic R&D collaboration to investigate novel protein degradation technology | $434 million milestone payment | |

Kymera Therapeutics, Inc. | July 2020 | Sanofi | Advancing novel protein degradation agent therapies to patients | $150 million upfront payment Over $2 billion potential milestone payment |

March 2019 | Vertex | Discovery and development of targeted protein degradation drugs for serious diseases | $70 million upfront payment, equity investment, and potential additional milestone payment and royalties for up to six projects in the collaboration | |

April 2018 | GlaxoSmithKline | Kymera Therapeutics Announces R&D Collaboration with GlaxoSmithKline to Advance New Therapeutic Modalities | — | |

C4 Therapeutics, Inc. | January 2019 | Biogen | Protein degradation platform using C4T for discovery and development of potential new therapies for neurological disorders such as Alzheimer's disease and Parkinson's disease | $415 million upfront payment, potential future milestone payment and potential future royalties |

January 2019 | Roche | Focus on new cancer therapies based on C4T-targeted protein degradation technology | $900 million upfront payment, potential future milestone payment | |

Nurix Therapeutics, Inc. | January 2021 | Sanofi | Expansion Agreement | Increase of $22 million in upfront payment |

January 2020 | Sanofi | Discovery, development and commercialization of s range of innovative targeted protein degradation drugs for challenging diseases in multiple therapeutic areas | $55 million upfront payment, and potentially up to approximately $2.5 billion in total payment | |

June 2019 | Gilead | Discovery, development and commercialization of a range of innovative targeted protein degradation drugs, with Gilead having the option to license candidate drugs for up to five targets | $45 million upfront payment, and potentially up to approximately $2.3 billion in total payment | |

Vividion Therapeutics, Inc. | March 2020 | Roche | PROTAC early drug discovery and preclinical studies | $135 million and up to billions in potential milestone payment |

August 2021 | Bayer | On August 5, Bayer AG announced the acquisition of Vividion, acquiring all rights to Vividion's proprietary discovery platform | Bayer will make a $1.5 billion upfront payment and a milestone payment of up to $500 million based on the successful achievement of targets | |

Seed Therapeutics, Inc. | November 2020 | Eli Lilly and Company | Co-development of a new class of chemical entities that act therapeutically by targeting protein degradation (TPD) | $10 million down payment, $790 million milestone payment and $10 million equity investment |

Table 3: PROTAC's Collaboration with Big Pharma

Note: The information was obtained from the official websites of the above companies.

Why DMPK researches are so critical to PROTAC drug development?

Despite the popularity of PROTAC technology due to its unique mechanism of action, the development of PROTAC molecules still faces multiple challenges (Figure 3)

Figure 3: PROTAC Research Difficulties and Importance

Oral administration is the ideal mode of drug delivery for the treatment of most diseases, but due to the unique structure of PROTAC resulting in a high molecular weight and poor solubility, making it is difficult for the drug properties to meet the classical Lipinski’s Rule of Five.

It has poor permeability in vivo and in vitro, leading to poor absorption and poor bioavailability.

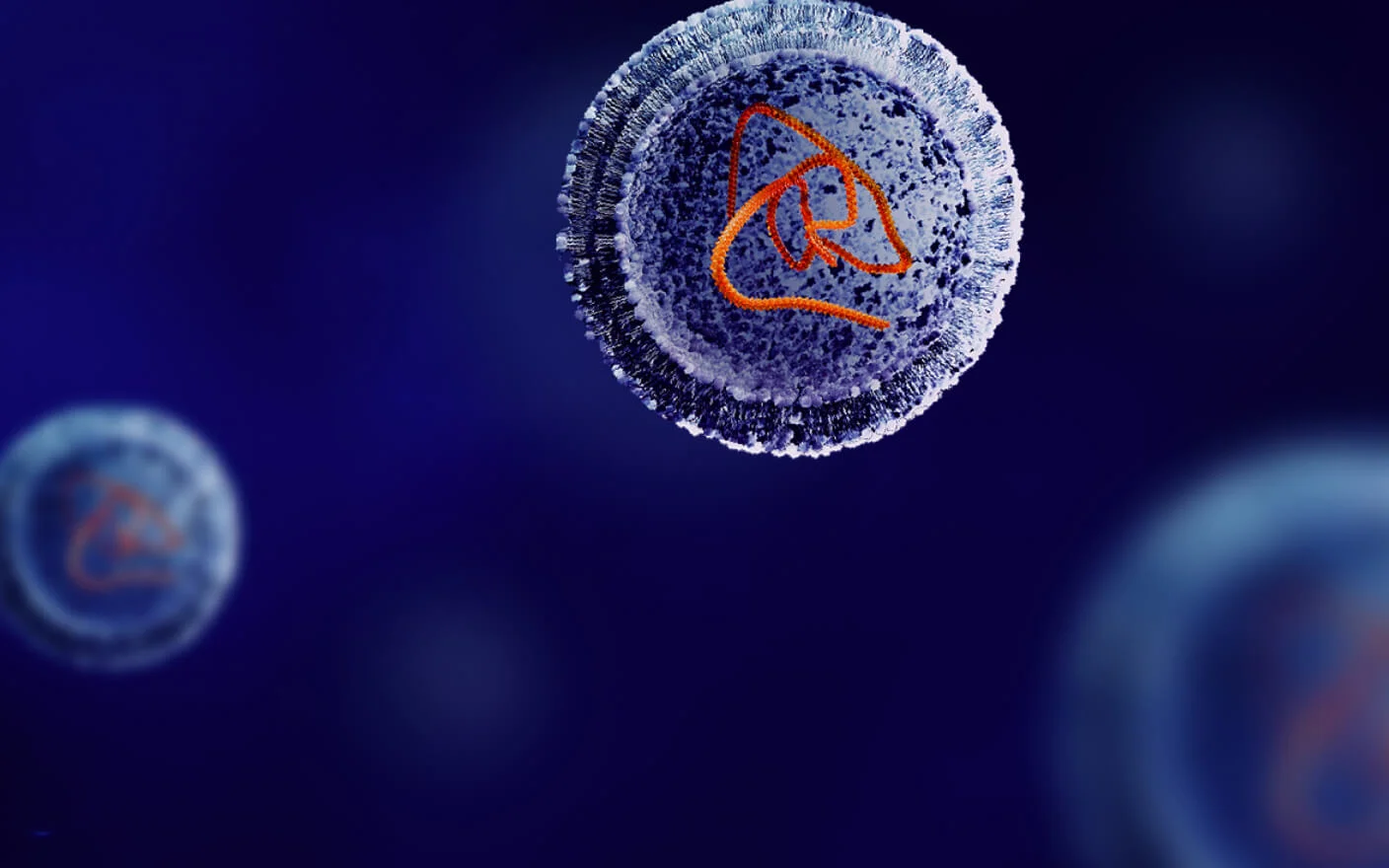

Several studies of PROTAC have shown that at appropriate or low concentrations a normal ternary complex is formed, while at high concentrations a target protein-PROTAC or E3 ligase-PROTAC binary complex is formed competitively, leading to reduced efficacy or toxic reactions, also known as the “hook effect” (Figure 4). This means that it is necessary to fully know the PKPD nature of PROTAC, thus timely adjusting the dosages.

Such molecules show high plasma protein binding in various species, and their plasma protein binding ratio may not be accurately detected when using the normal plasma protein binding method. In addition, the high plasma protein binding also slows down their metabolism, and some compounds are metabolized in plasma.

Due to the unique structure, metabolite generation can lead to unpredictable protein degradation, resulting in loss of efficacy and even toxic reactions. Therefore, in vivo metabolite monitoring is a crucial part of its preclinical screening, with particular attention to linker-cleavage metabolites.

There is no guidance specifically for PROTAC drugs, the guidance for small molecule drugs is generally referred to on a case-by-case basis.

Figure 4: Schematic representation of the hook effect

The Strategy of the DMPK study for the PROTAC drug

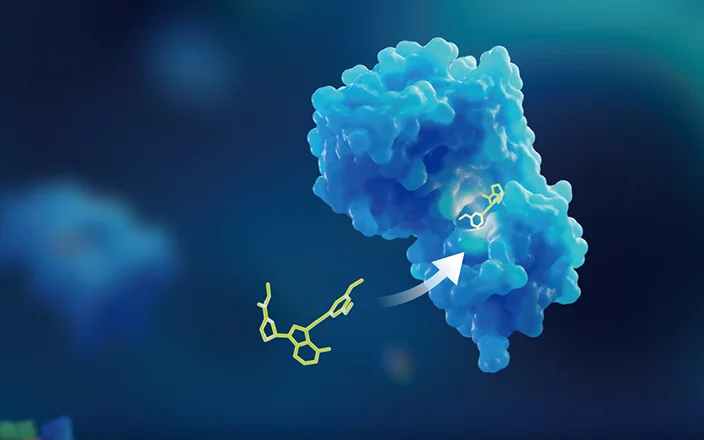

Preclinical optimization of PROTAC drugs is mainly performed through cascade optimization of physicochemical and DMPK properties (Figure 5).

(1) Because of the multiple challenges associated with PROTACs, drug developers should ensure consistent optimization of physicochemical and DMPK properties when designing a preclinical evaluation strategy. This needs to be performed during the early screening stage by first characterizing the in vitro properties of PROTAC molecules.

(2) In the optimization stage, the focus should be on improving the metabolic clearance and solubility of PROTAC, combined with the PK properties of extravascular drug delivery, to better understand the DMPK properties of PROTAC, such as absorption and metabolism. The permeability of PROTACs is a challenge for improving due to their structure. Orally administered PROTACs will require more attention to solubility and metabolic stability during this phase.

(3) At the PCC stage, PROTAC molecules with potent and better oral bioavailability can be used in further PK/PD studies to obtain a more in-depth exposure-response relationship.

Figure 5: Strategy and process of DMPK study for PROTAC drug.3

How WuXi AppTec DMPK could assist you in developing PROTAC

WuXi AppTec's DMPK Service Department has established a systematic platform for the DMPK study of PROTAC drugs based on extensive experience and a well-established in vitro and in vivo pharmacokinetic testing team. Our strengths include preclinical formulation screening, DMPK experimental design, selection of in vitro experimental methods, rapid speed of biological sample analysis, in vivo and in vitro metabolite identification capability, screening strategy and cross-departmental collaboration, effectively shortening the development cycle of PROTAC (Figure 6)

Figure 6: Advantages of WuXi AppTec DMPK in PROTAC study

Conclusion

Although there is no marketed drug for PROTAC, it is attracting more and more biopharmaceutical innovators and entrepreneurs to compete on this brand-new track. In more than 20 years of development, PROTAC has redefined small molecules with its unique mode of action. It breaks through the long-accepted rules of drug discovery and opens a new chapter for new drug development. WuXi AppTec DMPK expects more and more PROTAC molecules to be designed and developed, unlocking new opportunities in more disease areas, and bringing hope to more patients.

Click here to learn more about the strategies for PROTAC, or talk to a WuXi AppTec expert today to get the support you need to achieve your drug development goals.

*PROTAC® is a registered trademark of Arvinas. In this article, PROTAC specifically refers to the abbreviation of Proteolysis-Targeting Chimera as therapeutic modalities.

Authors: Chengyuan Li, Yu Wang, Jing Jin

Committed to accelerating drug discovery and development, we offer a full range of discovery screening, preclinical development, clinical drug metabolism, and pharmacokinetic (DMPK) platforms and services. With research facilities in the United States (New Jersey) and China (Shanghai, Suzhou, Nanjing, and Nantong), 1,000+ scientists, and over fifteen years of experience in Investigational New Drug (IND) application, our DMPK team at WuXi AppTec are serving 1,500+ global clients, and have successfully supported 1,200+ IND applications.

Reference

1 Balint Földesi, PaulDomanski. Recycling the Cell: Autophagy and the Ubiquitin-Proteasome Processes.biomol-blog, 2019.

2 Churcher I .Protac-induced Protein Degradation in Drug Discovery: Breaking the Rules – or Just Making New Ones?. Journal of Medicinal Chemistry, 2018, 61(2):444-452.

3 Cantrill C ,Chaturvedi P , Rynn C , et al. Fundamental aspects of DMPK optimization of targeted protein degraders. Drug Discovery Today, 2020, 25(6):969-982

Related Services and Platforms

Stay Connected

Keep up with the latest news and insights.